Hi {{first_name|there}}!

Money is no longer passive. It’s making decisions, routing itself, and showing up exactly where it’s needed.

With less than two weeks until Money20/20 Europe, this issue zeroes in on how embedded finance is shifting from optional add-on to core infrastructure—and where the smartest players are turning intelligence into operational advantage.

📝 Editor’s Note - Embedded Finance Is Becoming Infrastructure

Across Europe, the embedded finance model is shifting from concept to utility. With platforms now acting as distribution networks for financial products, the real work is happening behind the interface—at the infrastructure layer.

That shift is especially visible in SME finance. In the eurozone, small and mid-sized enterprises account for 99% of all businesses, yet access to credit remains uneven. According to an ECB survey, 27% of SMEs cited limited availability of bank loans as a key barrier—despite high demand for working capital due to inflation and supply chain volatility.

Embedded models are starting to fill those gaps. Companies like Liberis integrate directly with platforms where businesses already operate—eCommerce checkouts and accounting tools. This allows capital to flow without redirecting users to external lenders or requiring extensive paperwork. Acceptance rates improve when real-time sales data is used instead of outdated credit models. In Liberis’ case, more than 80% of funding decisions are automated, and partners include names like Worldpay and Shopify.

But embedded finance isn’t limited to lending. Sessions at this year’s Money20/20 point to a wider transition—where intelligence is embedded at the infrastructure level. Financial workflows are being rebuilt using real-time APIs, tokenized settlement rails, and machine-led decision systems that reduce risk exposure while enabling scale.

This model will pressure incumbents to move beyond front-end integrations. It requires rebuilding workflows around context, not channels. For European fintechs, that means funding must show up at the right moment inside the right product—and do so in a way that scales without increasing exposure.

📍 Want to hear from the teams building these systems?

Meet Liberis on site and ask how they’re embedding finance in the infrastructure of European commerce.

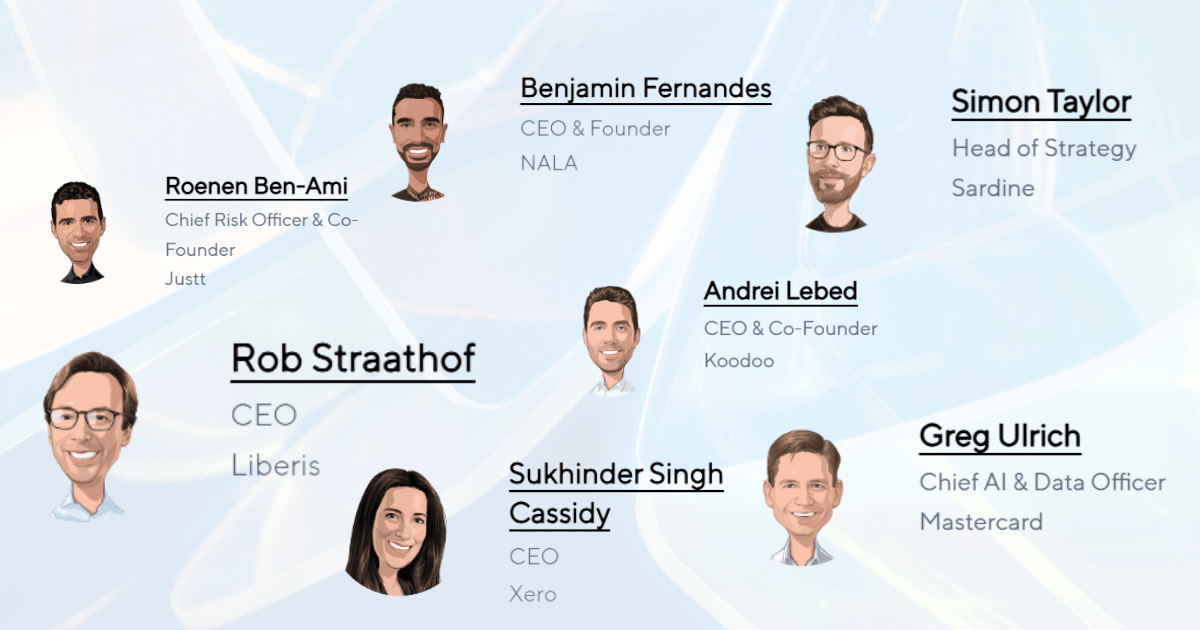

🎤 Who to Hear From

These leaders will be sharing embedded finance and intelligence insights at the event:

🚀 Where Scale Begins

The Startup Hub is built for action, not airtime. This year, it’s the most focused space at Money20/20 Europe for early and growth-stage founders to connect directly with decision-makers—and with content designed around the challenges startups actually face.

The sessions go beyond startup tropes. Expect honest frameworks and tested lessons, from “3 Myths That Will Break Your Startup (from a founder turned VC)” to “Enfuce: Scaling Up with Sisu” and “The Startup Playbook: How Airwallex Built Global Momentum.” Each talk is programmed to stress-test your thinking on capital, product, and scale.

But what makes the Hub essential is who’s paying attention. Confirmed investor presence includes:

If you're building infrastructure or shaping the next platform play, this is the room to be in.

📍 Want to pressure-test your value prop or share where you’re gaining traction?

Book a meeting with Bobsguide on site—we’ll be covering the ground and spotlighting the ideas that will define the next wave of fintech.

📈 Growth Thursday, Without the Spin

Growth Thursday is where scaling fintechs get specific. With panels covering brand strategy, embedded payments, and real-world co-opetition, this track speaks directly to the people responsible for revenue, customer growth, and competitive edge.

Who Should Attend

The Sessions Powering Growth

🕰️ Tuesday 3 June, 12:10–12:30, Horizon Stage

Fueling Entrepreneurship: Embedded Financing as a Catalyst for SMB Growth

➡️ Liberis supports SMB growth by embedding working capital directly into partner platforms. Its revenue-based model uses live sales data, not outdated credit scores, helping sellers access funding in the flow of business.

Rob Straathof will also return to the stage later that afternoon, joining leaders from Google Cloud, Barclays, and Softcat to tackle one of the most urgent challenges in AI adoption: trust. The panel will explore how transparent, explainable AI agents are shaping responsible innovation in lending and investment.

🕰️ Thursday 5 June, 10:45–11:15, Na.i.ture Stage

Brand Strategy, Made Simple: Unlocking Growth in Financial Services

📲 Like what you’re seeing?

The Unofficially Money20/20 Team

SPONSORED BY

Not affiliated with Money20/20

Bobsguide is a ClickZ Media publication